i always liked how stock market works.

it's too time consuming to perform analysis on individual companies and i often find myself giving up on following developments on the companies i like.

but i always follow news.

so that's why i decided to use funds and my own ideas while investing this year.

you'll understand the main investment flow i try this year when you read each due diligence.

1. my biggest position $motg:

global wide moat etf.

(https://www.vaneck.com/de/en/investments/global-moat-etf/overview/)

in 2026 i have to avoid risks or i should not lose any money (as always :D)

that's why i chose $motg since it invests companies with long term competitive advantages and monopolies (or almost monopolies).

since ai capex, semiconductor hype was the main theme in 2025, stock market can stabilize or enter a correction phase a bit in 2026. that's why my biggest position is a global defensive etf since i do not want to be affected by us equities' corrections and earn some money at the same time.

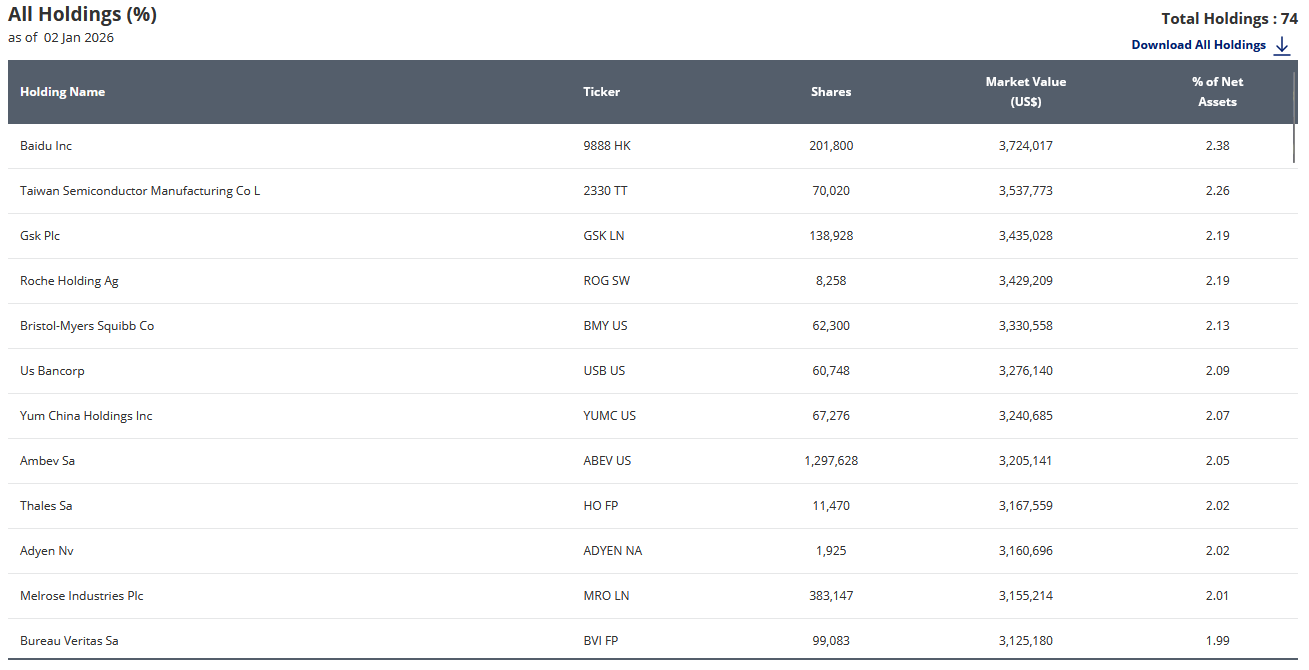

as you can see in below image the fund itself holds multiple equities all around the world, they're all quality companies and you can not step into their are easily.

since all the holding around the world and they're all quality companies i think it's a great choice to avoid risks in 2026 and stay defensive.

motg

motg

2. second biggest position: $icln

global clean energy etf.

(https://www.ishares.com/us/products/239738/ishares-global-clean-energy-etf)

the main idea is same with $motg: avoid us exposure in the portfolio, choose global etfs but this time the theme is different.

i think clean, renewable energy will be the main theme in coming years.

automotive industry enters the era of electirification and with the ai we are going to need more energy to meet the compute demand.

besides these two main topics, i observe that everyone started to use more and more electronic stuff in their daily life. this also increases the demand for the energy.

i see the near future more electronic and more hungry to the electric. that's why i chose $icln to invest.

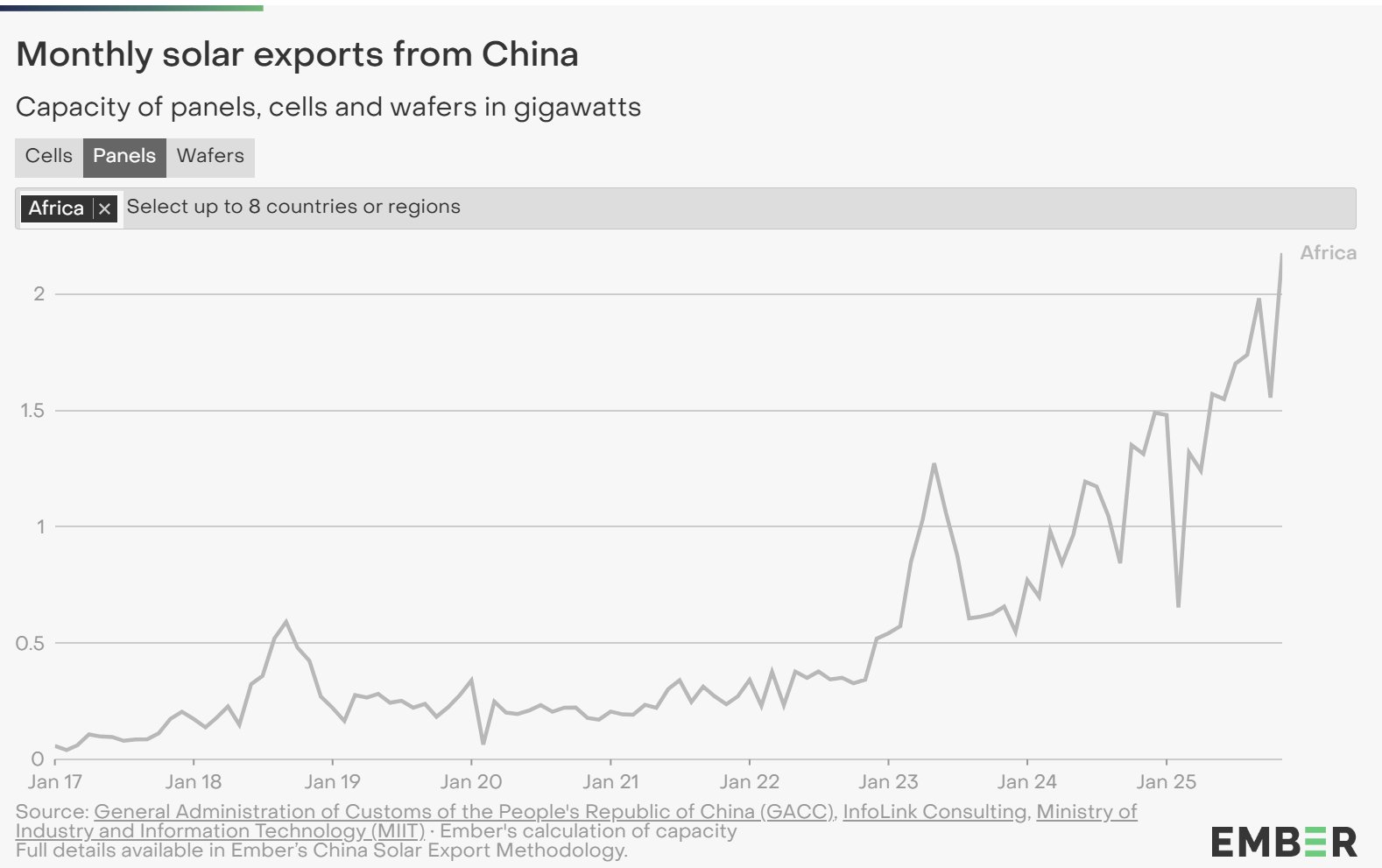

a greate example: africa started to use more and more chinese solar panels to produce more electric since they need it. people are saying that cities in africa are changing, thanks to cheap chinese solar panels. continent's solar panel import went to 2gw in last month which is a record for the continent.

chinaafrica

chinaafrica

future of energy is solar, wind and nuclear.

nuclear etfs are also seems like a great investment idea but i think they are too sensitive to the news around the world.

and oil sucks.

icln

icln

3. $toll:

durable quality etf.

(https://temaetfs.com/toll)

i like the idea of investing companies that i would like to work.

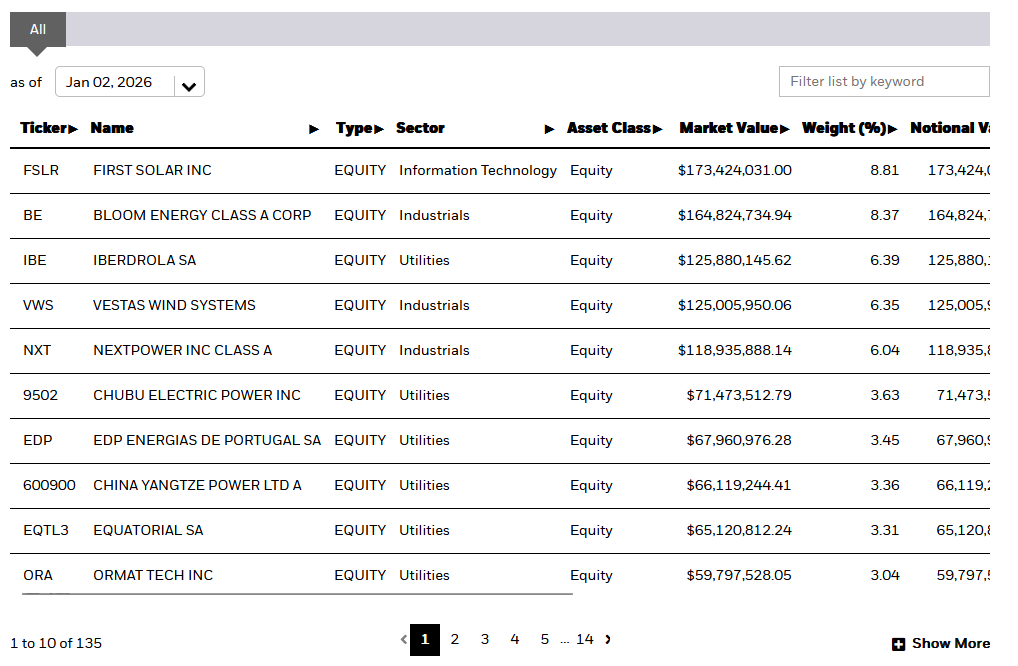

$toll is a great fund which holds lots of quality companies (mostly in us but couple in europe as well)

the investment philosophy of the fund is pretty similar to $motg. great companies with advantages (monopolies maybe) in their fields, hard to step into their area.

you want to buy an engine for your plane? you basically have no choice other then ge aerospace.

you want to use your credit card? visa or mastercard?

you want to manufacture some semiconductors? lam research corp.

you want to trade some commodities, global equities, derivatives? cboe.

i guess you can't avoid us equities while investing :D

toll

toll

4. $copa:

copper miners etf.

(https://themesetfs.com/etfs/copa)

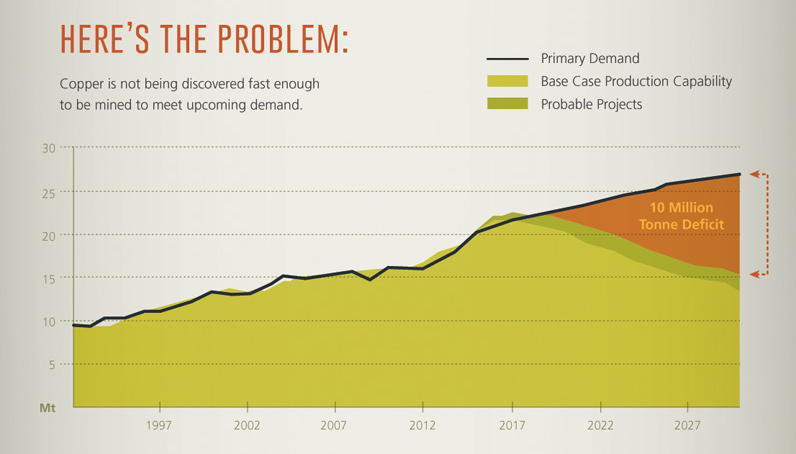

more electronics = more copper.

any stress in world politics = metals go up.

and below chart explains the supply issue in copper.

less supply = expensive product.

copper

copper